Mountain Biking Injury Insurance

![]() Injury Cover for Mountain Biking & Most Other Sports

Injury Cover for Mountain Biking & Most Other Sports

![]() Lump Sum for Fractures & Accidental Injuries

Lump Sum for Fractures & Accidental Injuries

![]() Daily Hospitalisation Benefit due to Accident or Sickness1

Daily Hospitalisation Benefit due to Accident or Sickness1

![]() Quote and Buy Online

Quote and Buy Online

The simplest way to buy sports accident and injury insurance online

Get the freedom to enjoy life without the worry of what might happen if you’re ill, injured or need to spend time in hospital.

Our service is free…. So how do we make a living?

We’re a FCA regulated insurance broker, so we don’t charge our customers any fees for arranging new cover. Instead, the provider you take the cover out with pays us a commission to cover our costs.

We will show you how much commission we have been paid by the provider on your personal illustration.

Why use us?

![]() Quote and buy online in minutes – the only place you can buy MetLife Everyday Protect online is right here

Quote and buy online in minutes – the only place you can buy MetLife Everyday Protect online is right here

![]() We’ve helped thousands of people all over the UK get the protection they need against sports injuries and general accidents

We’ve helped thousands of people all over the UK get the protection they need against sports injuries and general accidents

![]() Cover that Pays – Over £11 million paid out every year by MetLife EverdayProtect

Cover that Pays – Over £11 million paid out every year by MetLife EverdayProtect

![]() We never share your data with any 3rd parties without your explicit consent

We never share your data with any 3rd parties without your explicit consent

![]() We have an expert team to help you if you want it

We have an expert team to help you if you want it

![]() Guaranteed Acceptance with no medical questions or tests

Guaranteed Acceptance with no medical questions or tests

![]() We only work with established and reputable companies. MetLife provide EverydayProtect and have been helping customers globally for over 150 years

We only work with established and reputable companies. MetLife provide EverydayProtect and have been helping customers globally for over 150 years

What is Covered?

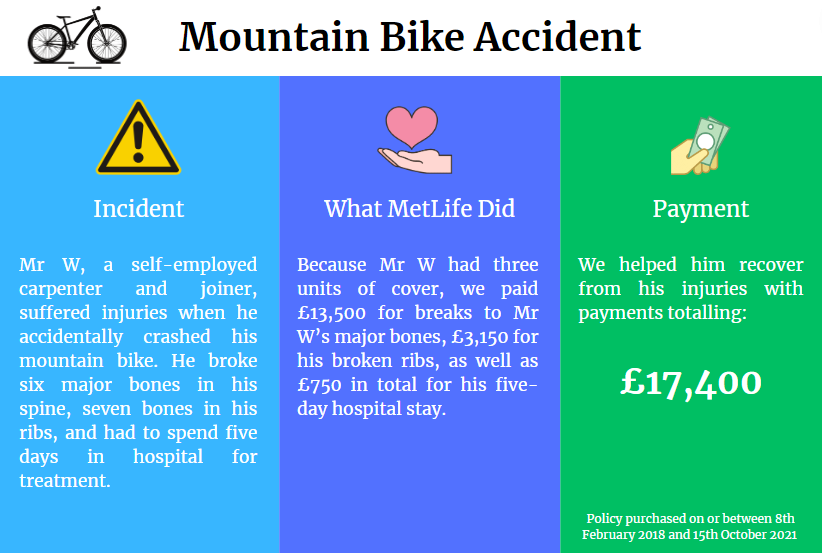

Mountain Biking Injury Insurance provides financial support for you 24/7 by covering a range of injuries from small broken bones to those that could have a significant impact on your life. You will also be covered if you have to spend time in a UK hospital and, with our extended cover options, you can protect your children as well.

If you play sport at any level, an injury can have a devastating effect on your finances. With Sports Injury Insurance you can play the sport you love without the worry of additional financial pain after an injury. Importantly, you will be covered whether you are playing sport or not, so if you are unlucky enough to have an accident at home, work or on the road, you are still fully covered. We’ve helped thousands of people all over the UK protect themselves against injuries and accidents. Rugby players, football players, cricketers, martial arts enthusiasts, american football players and cyclists are just some of the amateur sports people we have helped protect against injury.

By adding on Active Lifestyle Cover from only £1 a month extra, you can get additional cover in the event of you sustaining bodily injury caused by an accident, which results in a dislocation and/or either a tendon rupture or ligament tear. We’ll help you get back on track, so that you can keep enjoying the activities you love.

Sports Injury Insurance pays a lump sum for:

![]() Broken Bones – caused by an accident

Broken Bones – caused by an accident

![]() Accidental permanent injuries – including paralysis, loss of a hand or foot or loss of a major organ

Accidental permanent injuries – including paralysis, loss of a hand or foot or loss of a major organ

![]() Optional Active Lifestyle Cover to include ligament tears and ruptures

Optional Active Lifestyle Cover to include ligament tears and ruptures

![]() Accidental death

Accidental death

![]() UK hospital stays as a result of an accident – from 12 months you are also covered for hospital stays from sickness

UK hospital stays as a result of an accident – from 12 months you are also covered for hospital stays from sickness

![]() Up to £10,000 Funeral benefit (subject to deferred period)

Up to £10,000 Funeral benefit (subject to deferred period)

![]() Optional Child Benefit (Cover all of your dependent children from as little as £2 per month)

Optional Child Benefit (Cover all of your dependent children from as little as £2 per month)

![]() Optional Active Lifestyle benefit to cover one dislocation and one complete tendon rupture or complete ligament tear in each policy year.

Optional Active Lifestyle benefit to cover one dislocation and one complete tendon rupture or complete ligament tear in each policy year.

To find out more and for full details of all benefits and exclusions, please refer to your:

1Hospitilisation benefit for sickness available once you have had the cover in place for 12 months. 2£250,000 is the maximum pay out on the 5 unit plan from £50 per month. Policy subject to acceptance. Available to UK residents aged 18-64.

*Professional sports people are not covered and semi-professional players only covered if their main income comes from another source. MetLife define professional sport as ‘competitive sport undertaken on a professional, not amateur, basis as a main occupation and/or income’. So if a claim is made and the circumstances show that the individual was being paid to play sport they will need to ask further questions. MetLife will ask questions about any other occupations they have as well as the amount they are paid from all sources.

Everyday Protect Brochure

Everyday Protect Brochure